For many CFO’s, the answer to the question, “should I stop thinking of collections as time-based?” is simple: yes. If you and your collection agencies are still considering operating with time-based methodologies, you may be paying excessive fees to collection agencies and internal operations to collect on debtors with a high probability of paying. Conversely, you may not paying a compelling enough fee for more challenging receivables, thereby decreasing and delaying revenues.

The problem is that nearly all organizations bucket receivables by time (e.g., 30, 60, 90… days or primes, seconds, tertiary…), then roll the accounts from one bucket to the next when debtors don’t pay. This is the industry norm with time as one primary driver of collectability and the corresponding fee rate. This is simply an expensive, outdated model. The reality is that collectability has been – and will always be – about the consumer condition, and paying an average contingency fee for a group of disparate risk profiles by definition leads you to over or underpaying fees for the vast majority of your accounts.

There is a better way: use big data and predictive analytics to score each account for likelihood to pay right at the point of initial delinquency. Once scored, you can then assign a collection fee for each account or pool of similarly scored accounts – lower for higher likelihood to pay and higher for more difficult accounts. As more action is taken on each account, a dynamic scoring algorithm updates the account scores with collector activity and other pertinent information (e.g., credit score change, time of contact). This allows you to manage the agencies to the expected liquidity curves on the accounts.

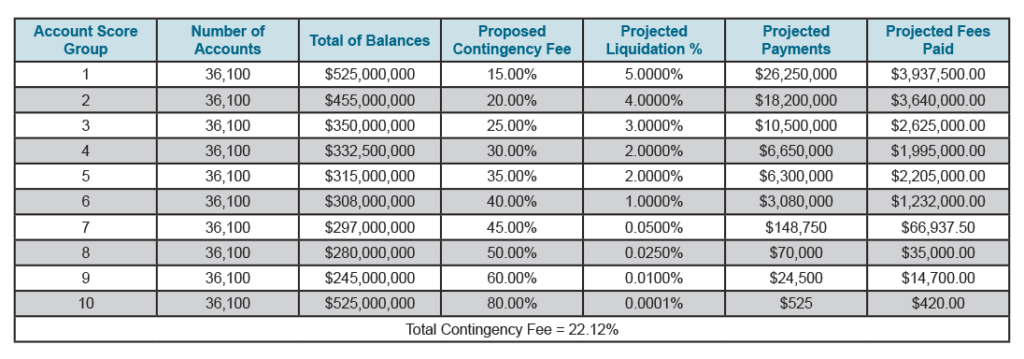

For example: if you were paying 25% on the entire portfolio of accounts (below), you would pay $18.5M in collection fees. Alternatively, if you paid fees based on score you would pay $15.7M – saving you $2.8M in fees – and, perhaps more importantly – this could be accomplished without hurting agency margins in the way that a standard fee cut would. As well, reduce customer complaints by not over-calling those unable to pay.

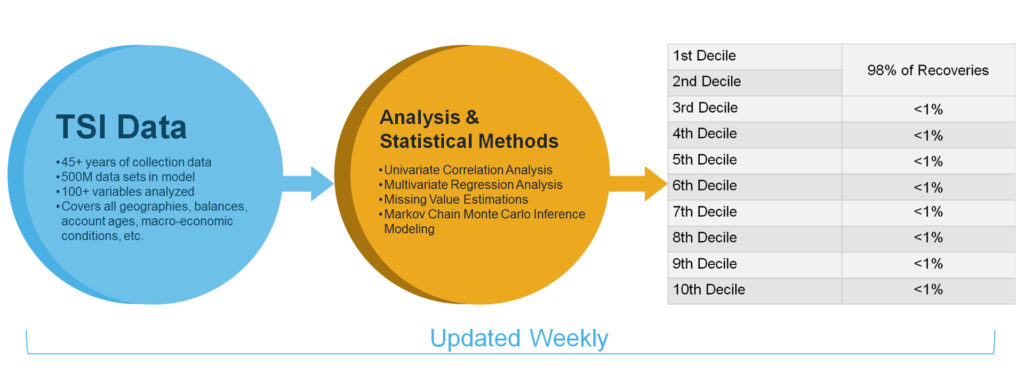

At TSI, we’ve applied score based collections with outstanding results: our recovery rates are 20% higher over the last 12 months resulting in millions of dollars of additional revenues for our clients. What enables us to achieve these results is our unique and broad data set and our proprietary analytics platform (CollectX), illustrated below.

TSI’s CollectX is truly groundbreaking technology, which now enables companies to shift from time-based collections to “risk-based” at a much lower cost to recover. TSI can provide portfolio management services leveraging CollectX to score and price your accounts, while also providing value-added account receivable services.

Whether you outsource to an agency or handle collections with your internal operations, you can leverage big data and predictive analytics to implement risk-based collection strategies to realize higher revenue and lower agency fees.

For more information, please contact TSI today.

———————

Want to learn more about TSI? Fill out the form and a TSI representative will contact you shortly.