Companies may sometimes become accustomed to thinking of bad debt as a cost of doing business. After all, every accounting department has to write off bad debt every once in a while, right?

That’s not necessarily the healthiest way to view any bad debt you may have out there. Instead of worrying about your write offs, you want to be able to focus on new sales, revenue growth, profitability, and brand awareness. And as we all know, reducing bad debt can, and will, have a direct impact on your bottom line.

By the Numbers

When you have to write off large portions of bad debt, you simultaneously must increase the pressure on your sales team and marketing staff to recoup the revenue you lost in those write-offs. Ultimately, you want your sales to drive growth, improve cash flow, and create new opportunities for your business.

A cash-positive business can hire more employees, expand into new locations, and upgrade equipment. When you’re drowning in bad debt, however, you’re too busy making up for losses.

If you’re using your sales to cover write-offs you’re reducing your business’s accounts receivable management efficiency and leaving money on the table. Worse, your sales, advertising, and marketing employees are faced with enormous stress as they scramble to improve customer acquisition and retention rates.

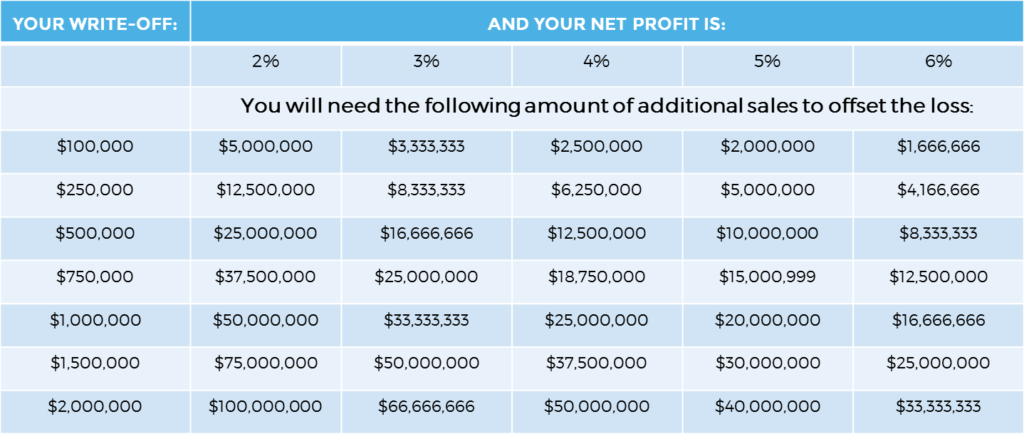

To understand how bad debt impacts sales, you need to know two metrics:

- Your net profit, and

- The amount of money you’ve written off.

Let’s say that you’ve written off $100,000 in bad debt and your profit margin is 5 percent. In this scenario, you’ll need to generate $2 million in profit to offset that loss.

Check your DSO numbers to determine whether you’re operating efficiently. Companies with a DSO of fewer than 45 days (and ideally 30 days) typically enjoy better cash flow and fewer write-offs. If your DSO has extended to 60 or 75 days, however, your bad debt could have an increasingly negative impact on your sales.

The solution is two-fold.

First, create a solid debt-collection strategy. Don’t wait until the 90-day mark to start calling customers and asking about unpaid invoices. Take a more active approach.

Consider working with a professional, third-party debt collection company. Some businesses don’t have the resources to mount a full-scale debt collection strategy cost up-front. Working with experienced experts should increase the amount of unpaid debt you collect, which automatically reduces potential write-offs – and offsets the relatively modest cost compared to in-house efforts.

Second, stop thinking about bad-debt write-offs as a cost of doing business. Profitable companies focus on revenue growth and stability. They don’t like to feel hampered by bad debt. “Fire” clients who don’t pay their bills, vet potential customers carefully and urge your sales team to take a full-funnel approach to acquiring and retaining clients.

Yes, bad debt can impact sales. Fortunately, there are available solutions to help avoid this trap. We encourage you to learn more about how to optimize your revenue so you don’t get stuck in the bad-debt trap.

Want to learn more about TSI? Fill out the form and a TSI representative will contact you shortly.