If you sell products or services on credit, then chances are that the words “accounts receivable” are enough to give you a headache.

Nevertheless, successfully managing your collections department is critical to your growth as a business. Recent numbers suggest that uncollected receivables could cost your company into the hundreds of thousands of dollars. Plus, surveys show that most businesses aren’t that great at staying on top of them.

Let’s take a closer look at how much your collections are costing your business, and what you can do to fix it.

Numbers Don’t Lie

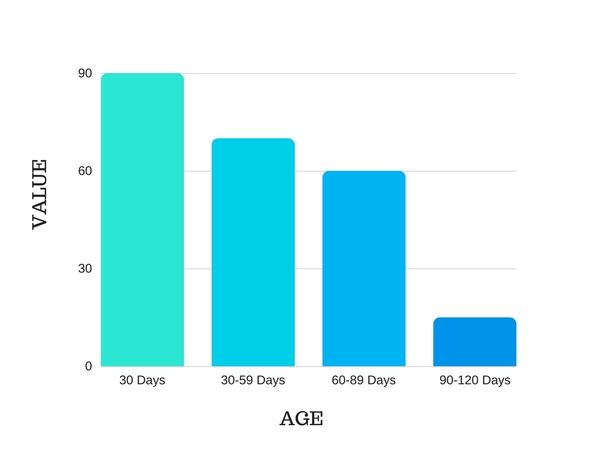

Figures from Inside Account Receivables Management clearly illustrate how receivables lose significant value over time. By the time they are 90 days overdue or more, they could be worth only 20% of their original value:

Not only is value lost on the money owed, but overburdened AR departments can cost your company in other ways. Increased workload, reduced productivity and resorting to bank debt to maintain cash flow are all symptoms of poor collections practices.

A payment practices study in 2016 proving that even though it’s costing them money, many American companies have room for improvement when managing their collections:

- On average, companies write off 1.5% of their receivables as bad debt.

- 93% of businesses experience late payments from customers.

- 47% of credit sales are paid late.

- Average payment terms are 27 days, but actual payment period averages 34 days.

- Survey participants see maintaining cash flow levels as a key challenge that is critical to business profitability.

Clearly, your accounts receivables could be costing your business a sizeable sum. However, there are a few best practices that you can implement today that will help to tighten up your collections department and allow you to put money back into your business.

Do The Math

The first step is to calculate your average collection period. This will give you a clear idea of the number of days on average it takes for your business to see receivables turn into cash.

A very informative post on The Balance outlines exactly how to perform this calculation. It requires some basic financial information about your business:

Days in Period x Average Accounts Receivable / Net Credit Sales = Average Days to Collection

Let’s break that formula down to its basic elements:

Days in Period — This can vary; it could be 365 days or 90 days; whatever works best within your business. The key is that however long this period is, all other parts of the formula must span the same number of days.

Average Accounts Receivable — Using the period of time established above, total the accounts receivable both at the beginning and at the end of the period. Then divide it by 2.

Net Credit Sales — This is the total of your gross sales minus the total of all returns during the set period.

For example, Company XYZ sees that their outstanding account receivables sit at $30,000 at the beginning of the year. By the end of the same year, they have risen to $36,000. Net credit sales came to $100,000 by the end of the year.

Using this example, the formula looks like this:

365 x 33,000 / 100,000 = 120.45

According to the math, it takes an average of 120 days for Company XYZ to see their account receivables resolved and translated into all-important cash flow.

Next Steps

Now that you have an idea of how long it takes credit customers to pay you, you can implement strategies to improve. For instance:

- Narrow your credit requirements to cut down on credit-consumers

- Train staff to clearly illustrate credit payment policies

- Be prepared to enforce your credit policies

- Incentivize early payment

- Consider enlisting outside help to manage accounts receivable

We are dedicated to helping companies collect their accounts receivable while maintaining customer service excellence. Our years of experience can help you streamline the process of debt collection, now and for the future, while optimizing cash flow and increasing productivity in all areas of your business. Contact us today to learn more.

Want to learn more about TSI? Fill out the form and a TSI representative will contact you shortly.